5 KPIs for Small Nonprofits to Track

For nonprofit professionals working on a small team, there are many priorities. Between planning your fundraising activities, or building relationships with your donors, how do you know if your efforts are worthwhile, or where you may need improvement. This can be done by using key performance indicators otherwise known as KPIs.

What is a key performance indicator?

KPIs are values that can be measured, and most importantly, they allow your organization to evaluate its fundraising progress. They use what’s referred to as a data-driven approach to fundraising, which means that you can make strategic decisions based on fact, rather than feeling. And, these indicators make it easier for your team to zero in on your fundraising objectives, and help your organization to understand the reasons behind a successful fundraising activity.

For example, an organization might want to gauge if personalized messages are more effective than generic "Dear Donor" letters in improving their donor retention rate. But, without comparing the retention rates before and after adopting this new approach, it can be tough to determine the effectiveness of personalizing donor communications.

When you are starting out it can be challenging to determine which KPIs to monitor, or where your fundraising efforts need a boost. So, here is a list of five simple yet effective KPIs that your organization can begin tracking to improve its fundraising performance.

Number of gifts. The number of donations an organization receives, also known as 'gifts', is an important KPI that your nonprofit can track. This KPI is typically tracked over a specific time frame, for example, a month or a year. The total number of these donations can provide a clear snapshot of your organization's fundraising efficiency and success. By comparing the number of donations to the same period from previous years, you can determine whether the number of donations you are securing is increasing or decreasing. This analysis can help your nonprofit make strategic decisions to boost its fundraising efforts.

Donor retention rate. Donor retention represents the number of donors who contributed to your cause last year, and have continued their generosity this year as well. Donor retention rates can vary significantly from organization to organization. However, if your retention rates are on the lower side, it may indicate that your organization might need to put more effort into cultivating stronger bonds with your donors. Let's illustrate this with an example. Suppose you had 45 donors who donated in the previous year. Out of these, 25 chose to donate again this year. By calculating the donor retention rate, which is (25/45) X 100, you get a retention rate of 55.6%. This tells you that just over half of your donors from last year have decided to continue supporting your cause this year.

Average gift amount. Knowing the average gift at your organization can be a valuable tool for your future planning. To illustrate, suppose an organization raises $12,000 and receives 125 donations. To calculate the average gift you simply divide the total sum raised by the total number of donations made. In this case, the average gift would be calculated as $12,000 divided by 125, which equals $96. Assessing the average donation size is an effective strategy that provides crucial data to guide your fundraising efforts. By understanding the average gift of different donor segments, your organization can create tailored annual appeal letters to your donors, potentially leading to higher donation amounts. This helps to make your fundraising campaigns more successful and effective.

Average number of days to thank a donor. Acknowledging a donor's contribution in a timely manner can greatly influence their decision to provide additional support in the future. If donors feel their gifts are not valued, they may not contribute again. Therefore, it's crucial to express gratitude promptly ,and within your organization’s capacity to encourage ongoing support. The average time taken to thank a donor can be determined by a simple calculation involving the sum of the days taken to thank each gift divided by the total number of gifts. To illustrate, let's consider an organization that receives four gifts, and the time taken to thank each donor is 10, 4, 28, and 26 days respectively. Add up these numbers to get a total of 68 days, then divide by the four gifts. The result is an average of 17 days to thank a donor for their gift. This calculation helps organizations set realistic expectations and improve their donor acknowledgment process.

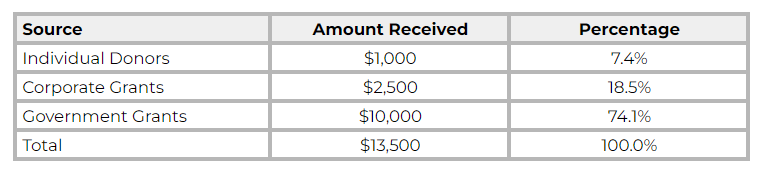

Percentage of revenue by source. Diversifying funding streams is crucial for your nonprofit organization's financial health. It's essential to examine your organization's revenue sources to ensure you're not overly dependent on one source of funding. Consider the organization in the example below that receives nearly three quarters of its funding from a single source. By analyzing their revenue sources, they could realize a potential risk. If they fail to secure their government grants, their operations could face significant difficulties. Therefore, it is important to take the time to evaluate and diversify your funding sources to minimize any potential risks. This approach not only ensures the sustainability of your operations but also safeguards your organization against unforeseen circumstances.

If tracking your organization’s performance is new, start with one KPI, and as you get accustomed to this process, gradually introduce more KPIs. By keeping an eye on even just a few KPIs, you can gain a clearer picture of what strategies are effective and which ones may need to be re-evaluated in your fundraising approach. The most critical factor, however, is consistency. Regular tracking of KPIs can significantly aid in advancing your organization towards achieving its fundraising goals.